When your energy bill says you’re “in credit,” it means you’ve paid more than what you’ve used in energy. This could happen if your estimated payments are higher than your actual usage.

On the other hand, being “in debit” means you’ve used more energy than you’ve paid for, so you owe money to the energy company. It’s important to understand these terms because they affect how much you pay and can help you adjust your energy usage or payments if needed. This article will explain these terms in detail and guide you on how to manage your energy bill effectively.

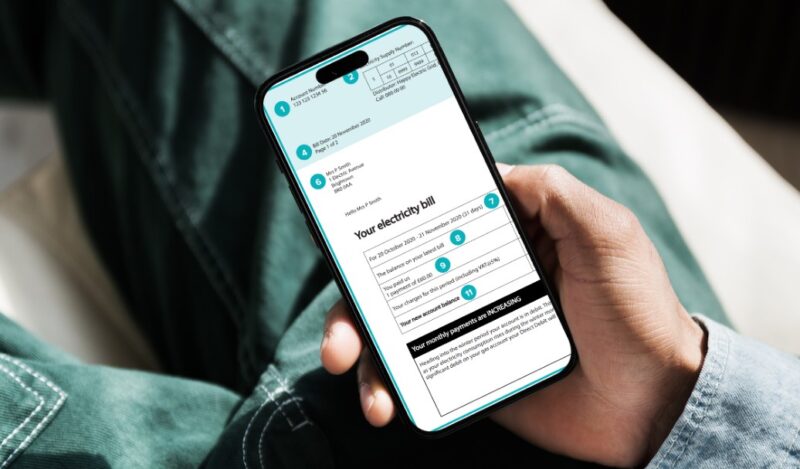

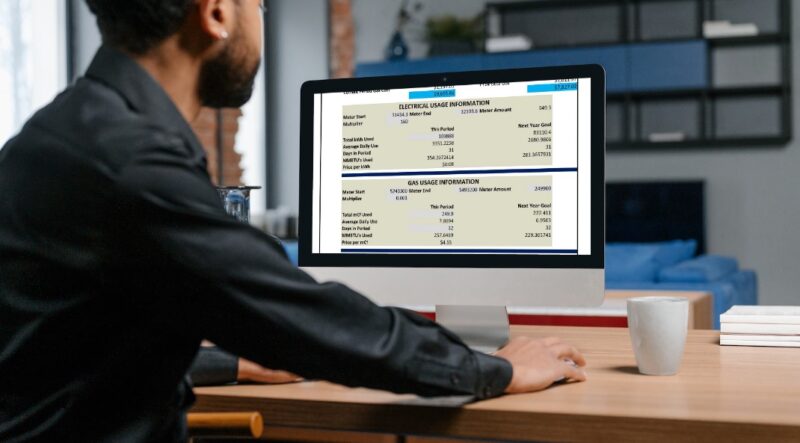

How to Check if I’m In Credit or In Debit?

- Review Your Bill: Look for terms like ‘in credit’ or ‘CR’ which indicate a surplus, or ‘in debit’ for a shortfall.

- Check Account Balance: Your bill’s account balance will show a negative number if you’re in debit (owing money), and a positive number or no sign if you’re in credit (the company owes you).

- Contact Your Supplier: If you’re unsure, contact your supplier directly. They may ask for a current meter reading to provide an accurate balance.

- Online Account: Log into your online account for real-time information on your balance.

- Meter Readings: Submit regular meter readings to ensure your bills reflect your actual usage and not just estimates.

What Are Reasons for Being In Debit?

- Seasonal Variations: Increased use during colder months for heating is a primary reason for being in debit.

- Estimated Bills: If your provider estimates your usage, it might not match your actual consumption, leading to a debit balance.

- Inaccurate Meter Readings: Sometimes, if the meter isn’t read correctly, it can result in a higher usage report than what was actually consumed.

- Payment Issues: Missed or late payments can also contribute to a debit balance on your account.

- Rate Increases: If rates go up and your payments don’t adjust accordingly, you might end up in debit.

- Change in Usage: A significant change in your lifestyle or household, like adding new appliances or more people living in your home, can increase usage unexpectedly.

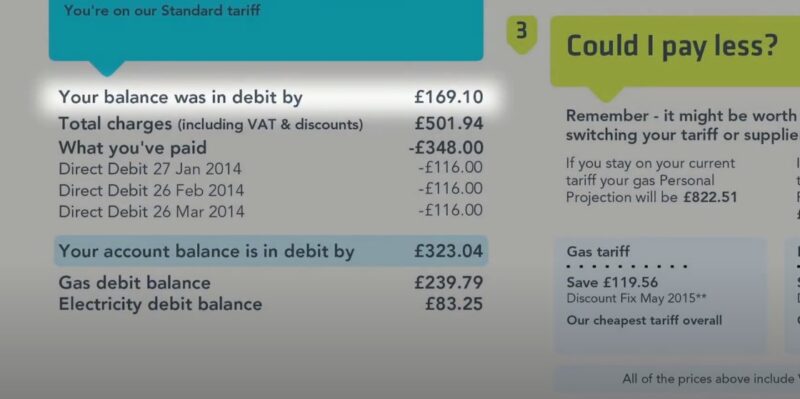

Details about Balance on Your Bill

Managing household finances requires a keen eye on various expenses, with utility bills often being a significant monthly outlay. A clear grasp of where your account stands with the provider is crucial.

When the balance tips towards a surplus, it reflects an overpayment. This situation can arise from estimated bills that overshoot actual consumption or a decrease in usage. While this might seem like a favorable position, it’s essential to consider the implications. The excess could be a buffer against future higher usage or an opportunity for reimbursement.

Conversely, a deficit indicates that the payments made have fallen short of the consumption costs. Such a scenario necessitates prompt action to prevent debt accumulation. It’s not uncommon for households to experience this during colder months when heating demands surge.

The providers typically offer tools and services to assist customers in tracking their usage. Online accounts, regular meter readings, and even smart meters provide real-time insights into the consumption.

These resources are invaluable for staying informed and making proactive adjustments to payment plans. For those who find themselves with a surplus, there are decisions to be made. Allowing the funds to sit in the account can offset future bills, especially if higher usage is anticipated.

Alternatively, requesting a refund to reallocate the money to other financial priorities is an option. It’s a matter of personal preference and financial strategy. In the case of a deficit, communication with the provider is key.

They can offer insights into why the account has fallen behind and suggest ways to catch up. Payment plans, energy-saving tips, and even checks for billing errors are all on the table. The goal is to bring the account back into balance without causing undue financial strain and avoid having to use some additional models to repay the bill, such as a Payday loan.

Seasonal Impact

The consumption patterns can vary greatly throughout the year, influenced by external temperatures and personal habits. As such, understanding how different seasons affect your bill is vital.

Winter and Summer Peaks

- During winter, heating systems work overtime, leading to higher energy usage.

- Summer months might see an increase in air conditioning use.

These seasonal peaks often result in higher bills, potentially leading to a debit situation if not managed properly.

Spring and Fall Adjustments

- Milder temperatures in spring and fall can reduce the need for heating and cooling.

- This is an ideal time to build up a credit balance to cushion against peak seasons.

Monitoring and Adjusting Payments

Regularly review your consumption and adjust your payments accordingly. If you find yourself in credit after a mild season, consider lowering your payments to avoid overpaying.

Energy-Saving Measures

Implement energy-saving measures during peak seasons to control costs. Simple actions like sealing drafts, using energy-efficient appliances, and adjusting thermostats can make a significant difference.

Communication with Your Provider

Keep in touch with your provider about seasonal payment plans. They may offer budget billing options to spread costs evenly throughout the year.

Rebates and Discounts

Energy bills are not just about consumption; they’re also about opportunities to save. Many providers offer rebates and discounts that can significantly reduce your overall costs. Here’s how you can take advantage of these offers:

What are Rebates?

Rebates are refunds offered by companies or government agencies to encourage energy-efficient practices. They often apply to specific actions, like purchasing energy-efficient appliances or making home improvements that reduce usage.

Eligibility and Application

Check with your provider or local government for available rebates. Eligibility criteria may include the type of home, location, or income level. Applications usually require proof of purchase or installation, so keep your receipts and documentation.

Discounts for Efficiency

Discounts may be available for customers who consistently use less energy than estimated. Some providers offer time-of-use rates, providing lower rates during off-peak hours.

Leverage Surplus

If you’re in credit, consider using the surplus to invest in energy-saving measures that qualify for rebates. This proactive approach can lead to long-term savings on your bills.

Manage the Consumption

Keeping your energy costs in check is a crucial part of household budgeting. Here are some strategies to help you manage your energy consumption effectively:

Track Your Usage

Use smart meters or monitoring apps to keep an eye on your daily energy use. Understanding your consumption patterns is the first step in controlling your costs.

Energy-Efficient Home Upgrades

Invest in insulation, double-glazing, or energy-efficient heating systems. These upgrades can lead to significant savings over time.

Behavioral Changes

Small changes in daily habits can have a big impact on your energy bill. Turn off lights when not in use, unplug devices, and use appliances during off-peak hours.

Regular Maintenance

Keep your heating and cooling systems well-maintained to ensure they run efficiently. Schedule annual check-ups and clean or replace filters regularly.

Renewable Options

Consider installing solar panels or subscribing to a green energy tariff. Using renewable energy sources can reduce your reliance on traditional power and lower your bills.

Seek Professional Advice

Energy audits can identify areas where you can cut costs. Professionals can provide tailored advice to make your home more energy-efficient.

Can You Switch a Supplier When In Credit or In Debit?

Switching suppliers when you have a balance on your account, whether it’s a credit or a debit, involves a few key steps and considerations:

If You’re ‘In Credit’:

- When you’re in credit, it means you’ve paid more than your actual usage.

- Upon deciding to switch, you’ll need to provide a final meter reading to your current supplier.

- Your current supplier will use this reading to generate a final bill and apply any credit to this charge.

- If there’s any leftover credit after settling the final bill, your supplier should refund the remaining amount to your bank account.

- You can also request a refund of your credit balance even if you’re not switching suppliers.

If You’re ‘In Debit’:

- Being in debit indicates that you owe money for energy you’ve already used.

- You’ll need to clear any outstanding balance before switching, as your current supplier might object to the transfer if there’s a debt.

- If you’re unable to pay off the entire amount, contact your supplier to discuss payment options or plans.

- In some cases, you may be able to switch suppliers even if you owe money, but you’ll still be responsible for paying off the debt to your previous provider.

FAQs

What does minus credit mean on a bill?

A minus credit on a bill indicates that you have overpaid and have a surplus in your account, which may be refunded to you or applied to future bills.

Is above zero in credit?

Yes, an account balance above zero is considered ‘in credit’, meaning you have paid more than your energy usage and may be eligible for a refund.

Does minus mean refund?

A minus sign on a bill typically means that you are due a refund because you have paid more than what was owed for the services or goods.

What steps should I take if I disagree with the ‘in debit’ amount on my energy bill?

If you disagree with the ‘in debit’ amount, you should first review your meter readings and compare them with the bill. If there’s still a discrepancy, contact your energy provider to resolve the issue.

Can I still switch energy suppliers if I’m on a fixed tariff and ‘in debit’?

Yes, you can switch energy suppliers even if you’re on a fixed tariff and ‘in debit’, but you’ll need to settle any outstanding balance with your current supplier before the switch can be completed.

Last Words

By staying informed and proactive, you can ensure that your energy bills accurately reflect your usage and that you’re taking advantage of all available savings opportunities.

Regularly reviewing your bills, submitting accurate meter readings, and maintaining open communication with your supplier are key practices that will help you maintain a balanced energy account.

Remember, your energy bill is more than just a statement of charges; it’s a tool that, when understood and used wisely, can lead to significant financial benefits.

Whether you’re enjoying a credit balance or addressing a debit situation, the power to manage your energy expenses effectively is in your hands.