In the fast-paced world of business, timely and accurate financial reporting is crucial for informed decision-making. One of the key components of this financial reporting process is the month-end reporting package.

This comprehensive set of documents provides a snapshot of a company’s financial health at the end of each month, offering valuable insights into performance, trends, and areas that may require attention.

Understanding what a month-end reporting package is and what it should contain is essential for financial professionals, business owners, and stakeholders who rely on this information to guide their strategies and operations.

In this article, we will delve into the essentials of a month-end reporting package, exploring its purpose, key components, and best practices for preparation and analysis.

Definition of a Month-End Reporting Package

A month-end reporting package is a comprehensive collection of financial and operational data compiled at the end of each month. This package serves as a critical tool for management, stakeholders, and financial analysts to assess the company’s performance, make informed decisions, and ensure financial accuracy and compliance.

Purpose and Importance

The primary purpose of a month-end reporting package is to provide a clear and concise summary of the company’s financial health and operational efficiency. It helps in identifying trends, variances, and potential issues that need to be addressed. The importance of this package lies in its ability to offer a snapshot of the company’s performance, facilitating strategic planning and decision-making.

Key Components

Financial Statements

Financial statements are the cornerstone of a month-end reporting package. They typically include:

- Income Statement (Profit and Loss Statement): This document provides a summary of the company’s revenues, expenses, and profits over the month.

- Balance Sheet: This statement outlines the company’s assets, liabilities, and equity at the end of the month.

- Cash Flow Statement: This report details the inflows and outflows of cash, highlighting the company’s liquidity and cash management.

Variance Analysis

Variance analysis compares actual financial performance against budgeted or forecasted figures. This analysis helps in understanding the reasons behind deviations and provides insights into areas that may require corrective actions.

Key Performance Indicators (KPIs)

KPIs are specific metrics that measure the company’s performance against its strategic goals. Common KPIs included in a month-end reporting package might be:

- Revenue Growth Rate

- Gross Profit Margin

- Operating Expenses Ratio

- Net Profit Margin

Operational Metrics

Operational metrics provide insights into the efficiency and effectiveness of the company’s operations. These metrics can vary depending on the industry but often include:

- Inventory Turnover

- Customer Acquisition Cost

- Employee Productivity

Reconciliations

Reconciliations ensure that the financial data is accurate and complete. Common reconciliations included in a month-end reporting package are:

- Bank Reconciliation: Verifying the company’s bank statements against its accounting records.

- Account Reconciliation: Ensuring that all accounts in the general ledger are accurate and up-to-date.

Management Commentary

Management commentary provides context to the financial and operational data. It includes explanations of significant events, trends, and variances, offering a narrative that helps stakeholders understand the numbers.

Frequency and Distribution

The month-end reporting package is typically prepared and distributed on a monthly basis. It is shared with key stakeholders, including senior management, board members, and sometimes external parties such as investors or auditors. The timely distribution of this package is crucial for effective decision-making and strategic planning.

Importance of Month-End Reporting

Financial Accuracy and Integrity

Month-end reporting ensures that all financial transactions for the month are accurately recorded and reconciled. This process helps in identifying and correcting any discrepancies, thereby maintaining the integrity of financial data. Accurate financial records are crucial for making informed business decisions and for meeting regulatory requirements.

Performance Evaluation

Month-end reports provide a snapshot of the company’s financial performance over the past month. This allows management to evaluate how well the company is performing against its financial goals and objectives. Key performance indicators (KPIs) such as revenue, expenses, and profit margins can be analyzed to assess operational efficiency and profitability.

Budgeting and Forecasting

Month-end reporting is essential for effective budgeting and forecasting. By comparing actual financial results with budgeted figures, companies can identify variances and understand the reasons behind them. This information is invaluable for adjusting future budgets and forecasts, ensuring that financial plans are realistic and achievable.

Cash Flow Management

Effective cash flow management is critical for the sustainability of any business. Month-end reports provide detailed insights into cash inflows and outflows, helping companies to manage their liquidity. Understanding cash flow patterns enables businesses to plan for future cash needs, avoid cash shortages, and make informed investment decisions.

Compliance and Regulatory Requirements

Many industries are subject to stringent regulatory requirements that mandate regular financial reporting. Month-end reporting helps companies to comply with these regulations by providing timely and accurate financial information. Non-compliance can result in legal penalties, fines, and damage to the company’s reputation.

Stakeholder Communication

Month-end reports are a key tool for communicating financial performance to stakeholders, including investors, creditors, and board members. Transparent and accurate reporting builds trust and confidence among stakeholders, which is essential for securing investment and financing. It also provides stakeholders with the information they need to make informed decisions about their involvement with the company.

Strategic Decision-Making

Month-end reporting provides the data needed for strategic decision-making. By analyzing financial trends and performance metrics, management can identify opportunities for growth, areas for cost reduction, and potential risks. This enables the company to make proactive decisions that align with its long-term strategic goals.

Operational Efficiency

The process of preparing month-end reports often involves reviewing and streamlining internal processes. This can lead to improved operational efficiency as inefficiencies and bottlenecks are identified and addressed. Enhanced operational efficiency can result in cost savings and improved overall performance.

Historical Data Analysis

Month-end reports contribute to the accumulation of historical financial data, which is valuable for trend analysis and benchmarking. By examining historical data, companies can identify patterns and trends that can inform future business strategies. Historical analysis also helps in setting realistic performance targets and measuring progress over time.

Key Components of a Month-End Reporting Package

Financial Statements

Income Statement

The income statement, also known as the profit and loss statement, provides a summary of the company’s revenues, expenses, and profits over the reporting period. It helps stakeholders understand the company’s operational efficiency and profitability.

Balance Sheet

The balance sheet offers a snapshot of the company’s financial position at the end of the reporting period. It includes assets, liabilities, and shareholders’ equity, providing insights into the company’s liquidity and financial stability.

Cash Flow Statement

The cash flow statement details the inflows and outflows of cash within the company. It is divided into three sections: operating activities, investing activities, and financing activities. This statement is crucial for understanding the company’s cash management and financial health.

Variance Analysis

Budget vs. Actual

This analysis compares the actual financial performance against the budgeted figures. It highlights variances, both favorable and unfavorable, and helps in understanding the reasons behind these differences.

Prior Period Comparison

Comparing the current month’s performance with previous periods (e.g., last month, same month last year) provides context and helps identify trends, seasonality, and areas needing attention.

Key Performance Indicators (KPIs)

Financial KPIs

These include metrics such as gross profit margin, net profit margin, return on assets (ROA), and return on equity (ROE). Financial KPIs help in assessing the company’s financial health and operational efficiency.

Operational KPIs

Operational KPIs might include metrics like inventory turnover, days sales outstanding (DSO), and days payable outstanding (DPO). These indicators provide insights into the company’s operational effectiveness and efficiency.

Reconciliations

Bank Reconciliation

This involves comparing the company’s bank statements with its accounting records to ensure consistency and accuracy. It helps in identifying discrepancies and ensuring that all transactions are accounted for.

Account Reconciliation

Reconciliation of key accounts, such as accounts receivable, accounts payable, and inventory, ensures that the balances in the financial statements are accurate and complete.

Supporting Schedules

Accounts Receivable Aging Report

This report categorizes outstanding receivables based on the length of time they have been due. It helps in assessing the effectiveness of the company’s credit policies and identifying potential collection issues.

Accounts Payable Aging Report

Similar to the accounts receivable aging report, this report categorizes outstanding payables. It helps in managing the company’s cash flow and ensuring timely payments to suppliers.

Inventory Report

An inventory report provides details on the quantity and value of inventory on hand. It helps in managing stock levels, identifying slow-moving items, and ensuring accurate valuation of inventory.

Management Commentary

Executive Summary

The executive summary provides a high-level overview of the company’s financial performance, key achievements, and challenges during the reporting period. It is typically written by senior management and offers insights into strategic decisions and future outlook.

Detailed Analysis

This section includes a more in-depth analysis of the financial statements, variances, and KPIs. It provides explanations for significant changes and trends, offering a comprehensive understanding of the company’s performance.

Compliance and Regulatory Information

Tax Compliance

Details on tax liabilities, payments, and any outstanding issues are included to ensure compliance with tax regulations. This section may also cover any changes in tax laws that could impact the company.

Regulatory Filings

Information on any required regulatory filings, such as those with the Securities and Exchange Commission (SEC) or other regulatory bodies, is included to ensure compliance with legal requirements.

Financial Statements and Reports

Income Statement

The income statement, also known as the profit and loss statement, provides a summary of a company’s revenues, expenses, and profits or losses over a specific period. It is essential for assessing the financial performance of the business. Key components include:

- Revenue: Total income generated from sales or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs required to run the business, such as salaries, rent, and utilities.

- Operating Income: Gross profit minus operating expenses.

- Net Income: The final profit after all expenses, taxes, and interest have been deducted.

Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It is divided into three main sections:

- Assets: Resources owned by the company, including current assets (cash, accounts receivable, inventory) and non-current assets (property, equipment, long-term investments).

- Liabilities: Obligations the company owes to others, including current liabilities (accounts payable, short-term debt) and long-term liabilities (long-term debt, deferred tax liabilities).

- Equity: The residual interest in the assets of the company after deducting liabilities, including common stock, retained earnings, and additional paid-in capital.

Cash Flow Statement

The cash flow statement outlines the inflows and outflows of cash within the company over a specific period. It is divided into three sections:

- Operating Activities: Cash generated or used in the core business operations, such as receipts from customers and payments to suppliers.

- Investing Activities: Cash used for or generated from investments in assets, such as purchasing equipment or selling investments.

- Financing Activities: Cash flows related to borrowing and repaying debt, issuing stock, and paying dividends.

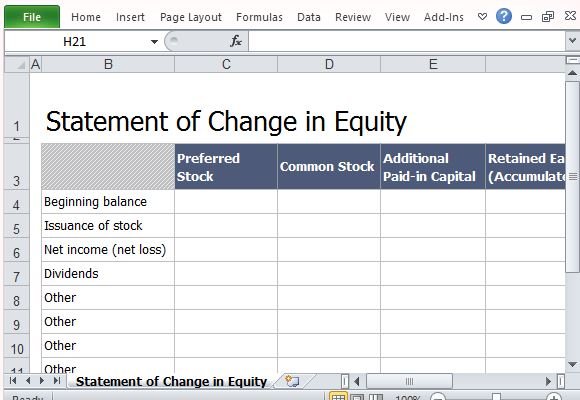

Statement of Changes in Equity

This statement details the changes in the company’s equity over a reporting period. It includes:

- Opening Balance: The equity at the beginning of the period.

- Additions: Contributions from owners, net income, and other increases.

- Deductions: Dividends paid, losses, and other decreases.

- Closing Balance: The equity at the end of the period.

Notes to the Financial Statements

The notes provide additional context and details that are not included in the main financial statements. They cover:

- Accounting Policies: Methods and principles used in preparing the financial statements.

- Contingent Liabilities: Potential liabilities that may occur depending on the outcome of future events.

- Commitments: Future obligations that the company has committed to, such as lease agreements.

- Related Party Transactions: Transactions with entities or individuals that have a close relationship with the company.

Management Discussion and Analysis (MD&A)

The MD&A section offers management’s perspective on the financial results and condition of the company. It includes:

- Financial Performance: Analysis of revenue, expenses, and profitability.

- Liquidity and Capital Resources: Discussion on the company’s ability to meet short-term and long-term obligations.

- Risk Factors: Identification and analysis of potential risks that could impact the company’s financial health.

- Forward-Looking Statements: Projections and expectations for future performance based on current trends and assumptions.

Operational Metrics and KPIs

Definition and Importance

Operational Metrics and Key Performance Indicators (KPIs) are quantifiable measures that organizations use to track and assess the efficiency and effectiveness of their operations. These metrics provide insights into various aspects of the business, enabling management to make informed decisions, identify areas for improvement, and ensure alignment with strategic goals.

Common Operational Metrics

Revenue Metrics

- Total Revenue: The total income generated from sales of goods or services.

- Revenue Growth Rate: The percentage increase in revenue over a specific period.

- Recurring Revenue: Income that is expected to continue in the future, such as subscription fees.

Cost Metrics

- Cost of Goods Sold (COGS): The direct costs attributable to the production of the goods sold by a company.

- Operating Expenses: The expenses required for the day-to-day functioning of the business.

- Cost per Acquisition (CPA): The cost associated with acquiring a new customer.

Efficiency Metrics

- Inventory Turnover: The number of times inventory is sold and replaced over a period.

- Order Fulfillment Cycle Time: The time taken from receiving an order to delivering it to the customer.

- Utilization Rate: The percentage of total capacity that is actually used.

Key Performance Indicators (KPIs)

Financial KPIs

- Gross Profit Margin: The difference between revenue and COGS divided by revenue, expressed as a percentage.

- Net Profit Margin: The percentage of revenue remaining after all expenses have been deducted.

- Return on Investment (ROI): A measure of the profitability of an investment.

Customer KPIs

- Customer Satisfaction Score (CSAT): A measure of customer satisfaction with a product or service.

- Net Promoter Score (NPS): A metric that gauges customer loyalty and the likelihood of them recommending the company to others.

- Customer Retention Rate: The percentage of customers who continue to do business with the company over a given period.

Operational KPIs

- First Pass Yield (FPY): The percentage of products that meet quality standards without requiring rework.

- Overall Equipment Effectiveness (OEE): A measure of how well manufacturing equipment is utilized.

- Employee Productivity: The output per employee, often measured in terms of revenue or units produced.

How to Select the Right Metrics and KPIs

Alignment with Business Goals

Ensure that the selected metrics and KPIs are aligned with the strategic objectives of the organization. This alignment helps in tracking progress towards achieving these goals.

Relevance and Actionability

Choose metrics that are relevant to the specific operations and can drive actionable insights. Avoid metrics that do not provide meaningful information or cannot influence decision-making.

Data Availability and Accuracy

Ensure that the data required to calculate the metrics and KPIs is readily available and accurate. Reliable data is crucial for making informed decisions.

Regular Review and Update

Regularly review and update the metrics and KPIs to ensure they remain relevant and reflect the current business environment. This practice helps in adapting to changes and maintaining focus on critical areas.

Best Practices for Reporting Operational Metrics and KPIs

Visualization

Use visual aids such as charts, graphs, and dashboards to present the metrics and KPIs. Visualization makes it easier to understand trends and patterns.

Contextual Information

Provide context for the metrics and KPIs by including historical data, benchmarks, and industry standards. This context helps in interpreting the numbers accurately.

Frequency of Reporting

Determine the appropriate frequency for reporting each metric and KPI. Some may require daily tracking, while others might be more suitable for weekly or monthly reviews.

Stakeholder Communication

Tailor the reporting to the needs of different stakeholders. Ensure that the information is relevant and understandable to the intended audience, whether they are executives, managers, or operational staff.

Compliance and Regulatory Information

Importance of Compliance in Month-End Reporting

Compliance in month-end reporting ensures that the financial statements and reports adhere to the laws, regulations, and standards set by governing bodies. This is crucial for maintaining the integrity and transparency of financial information, which in turn fosters trust among stakeholders, including investors, regulators, and the public.

Key Regulatory Frameworks

Generally Accepted Accounting Principles (GAAP)

GAAP is a collection of commonly followed accounting rules and standards for financial reporting. Companies in the United States are required to follow GAAP to ensure consistency, reliability, and comparability of financial statements.

International Financial Reporting Standards (IFRS)

IFRS is a set of accounting standards developed by the International Accounting Standards Board (IASB). These standards are used internationally and are designed to bring consistency to accounting language, practices, and statements, making it easier for companies to compare financial information across borders.

Sarbanes-Oxley Act (SOX)

The Sarbanes-Oxley Act of 2002 is a U.S. federal law that aims to protect investors by improving the accuracy and reliability of corporate disclosures. SOX compliance requires rigorous internal controls and procedures for financial reporting, and mandates that senior executives take personal responsibility for the accuracy of financial statements.

Essential Compliance Components in Month-End Reporting

Financial Statement Accuracy

Ensuring that all financial statements, including the balance sheet, income statement, and cash flow statement, are accurate and free from material misstatements. This involves thorough reconciliation of accounts and verification of all financial data.

Internal Controls

Implementing and maintaining robust internal controls to prevent and detect errors or fraud. This includes segregation of duties, authorization and approval processes, and regular audits.

Documentation and Record-Keeping

Maintaining comprehensive documentation and records of all financial transactions and reporting processes. This is essential for audit trails and for demonstrating compliance with regulatory requirements.

Timely Reporting

Adhering to deadlines for financial reporting as stipulated by regulatory bodies. Timely reporting is critical to ensure compliance and to provide stakeholders with up-to-date financial information.

Reporting to Regulatory Authorities

Filing Requirements

Understanding and meeting the filing requirements of various regulatory authorities, such as the Securities and Exchange Commission (SEC) in the U.S. This includes submitting periodic reports, such as quarterly and annual financial statements, and any other required disclosures.

Disclosure Requirements

Ensuring that all required disclosures are made in the financial statements and reports. This includes disclosing any material events, related party transactions, and other information that may impact the financial health of the company.

Compliance Audits

Internal Audits

Conducting regular internal audits to assess the effectiveness of internal controls and compliance with regulatory requirements. Internal audits help identify areas of improvement and ensure ongoing adherence to compliance standards.

External Audits

Engaging external auditors to provide an independent assessment of the company’s financial statements and compliance with regulatory requirements. External audits enhance the credibility of financial reports and provide assurance to stakeholders.

Penalties for Non-Compliance

Financial Penalties

Non-compliance with regulatory requirements can result in significant financial penalties, including fines and sanctions. These penalties can have a substantial impact on the company’s financial health and reputation.

Legal Consequences

In severe cases, non-compliance can lead to legal consequences, including lawsuits and criminal charges against the company and its executives. This underscores the importance of adhering to all regulatory requirements in month-end reporting.

Best Practices for Preparing a Month-End Reporting Package

Establish a Clear Timeline

Setting a clear timeline is crucial for the timely preparation of a month-end reporting package. Define key deadlines for data collection, analysis, and report compilation. Ensure all team members are aware of these deadlines and understand their roles and responsibilities. This helps in avoiding last-minute rushes and ensures that the report is accurate and comprehensive.

Standardize the Reporting Format

A standardized reporting format ensures consistency and makes it easier to compare data across different periods. Use templates that include all necessary sections such as financial statements, key performance indicators (KPIs), and variance analysis. Consistent formatting also aids in quicker review and approval processes.

Automate Data Collection

Automating data collection can significantly reduce errors and save time. Utilize accounting software and other financial tools that can automatically pull data from various sources. This not only speeds up the process but also ensures that the data is accurate and up-to-date.

Reconcile Accounts Early

Reconciling accounts early in the process helps in identifying and resolving discrepancies before they become major issues. Regularly reconcile bank statements, accounts receivable, and accounts payable. This practice ensures that the financial data is accurate and reliable.

Review and Validate Data

Before finalizing the report, thoroughly review and validate all data. Cross-check figures, ensure that all transactions have been recorded, and verify that the data aligns with supporting documents. This step is crucial for maintaining the integrity of the report.

Include Detailed Explanations

Provide detailed explanations for any significant variances or anomalies in the data. This helps stakeholders understand the reasons behind the numbers and provides context for better decision-making. Include notes and comments where necessary to clarify complex information. Exec Capital are leading Executive Recruiters.

Focus on Key Metrics

While it’s important to provide comprehensive data, focusing on key metrics can make the report more actionable. Highlight critical KPIs that align with the organization’s goals and objectives. This helps in drawing attention to the most important aspects of the financial performance.

Ensure Compliance

Ensure that the month-end reporting package complies with relevant accounting standards and regulations. This includes adhering to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), as applicable. Compliance ensures that the report is credible and can be used for external reporting if needed.

Facilitate Collaboration

Encourage collaboration among different departments to gather all necessary information. Use collaborative tools and platforms to streamline communication and data sharing. This ensures that the report is comprehensive and includes input from all relevant stakeholders.

Continuous Improvement

Regularly review and refine the month-end reporting process. Gather feedback from team members and stakeholders to identify areas for improvement. Implement changes to enhance efficiency, accuracy, and the overall quality of the reporting package.